Due to changes effective January 1, 2013, the Florida Motor Vehicle No-Fault Law now codified the insured’s obligation to submit to an examination under oath (EUO). The newly amended statutory language explicitly states:

An insured seeking benefits under ss. 627.730–627.7405, including an omnibus insured, must comply with the terms of the policy, which include, but are not limited to, submitting to an examination under oath. The scope of questioning during the examination under oath is limited to relevant information or information that could reasonably be expected to lead to relevant information. Compliance with this paragraph is a condition precedent to receiving benefits. An insurer that, as a general business practice as determined by the office, requests an examination under oath of an insured or an omnibus insured without a reasonable basis is subject to s. 626.9541.

Fla. Stat. § 627.736(g)(6). (2013). At first it may seem odd that the Florida legislature had to go to such great lengths to incorporate, and explicitly condition, the receipt of no-fault benefits on the insured’s submission to an examination under oath. However, a brief look at the recent trends leading to this change demonstrates why the Florida legislature rewrote insurance contract law in the no-fault context.

First, we turn to the purpose of no-fault insurance. In a nutshell, the purpose of no-fault insurance policies is to reduce contentious and costly resolution of automobile accidents. The proposition is simple – if each party involved in an accident is reimbursed by his own insurance company, it reduces the need for insurance claims adjusters and counsel to go to court to determine which company is responsible for what damages. Florida is among 12 states with a no-fault law.

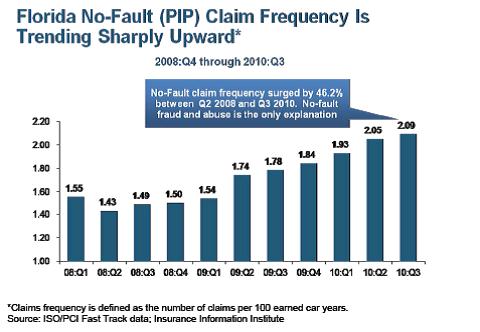

Next, we look at whether Florida’s no-fault law is actually fulfilling its intended purpose. The simple answer is no. Despite the intent of the no-fault system to expedite claims and create equity, recent studies have demonstrated a rising number of Florida no-fault (PIP) claims. The Insurance Information Institute1 comparisons of the rise in such claims is illustrated in the chart below.

One of the immediate questions raised is whether the increase in claim frequency is due to the fact that these claims are not intended to be scrutinized because of the nature of no-fault law. In other words, does the seemingly equitable purpose of providing swift and virtually automatic payment invite a bevy of questionable claims? And, if that is the case, how do you investigate the claims and hold the claimants accountable? Legitimate or not, the dramatic increase in these numbers have caused concern about the efficacy of Florida no-fault’s scheme. In the face of rising PIP claims and increased instances discovering insurance fraud, the Florida legislature has a heightened concern. Evidence of that concern is found in the following statutory notation:

The Office of Insurance Regulation shall perform a comprehensive personal injury protection data call and publish the results by January 1, 2015. It is the intent of the Legislature that the office design the data call with the expectation that the Legislature will use the data to help evaluate market conditions relating to the Florida Motor Vehicle No-Fault Law and the impact on the market of reforms to the law made by this act.

Fla. Stat. § 627.736 (2013). Having seen, quantitatively, the opposite effect of intent of Florida no-fault law, we turn to how the issues involving these claims has been addressed in Florida courts.

The Florida Supreme Court’s decision in Custer Medical Center v. United Automobile Ins. Co., 62 So. 3d 1086, 1088-89 (Fla. 2010), became the basis for subsequent decisions on the issue of whether an insured had an obligation to submit to an examination under oath as a condition precedent of collecting insurance benefits. Interestingly, Custer involved an insurer’s denial of PIP benefits based on the insured’s failure to appear for a medical examination. Although examinations under oath were not directly at issue, the rationale in the Custer case became the fulcrum for subsequent court decisions. Relying on Custer, Florida courts issued subsequent decisions upholding the insured’s right to insurance benefits without obligations. See e.g. Defran Medical Associates Corp. v. State Farm Mutual Auto Ins. Co., 19 Fla. L. Weekly Supp. 213a (Dec. 1, 2011) (relying on Custer, granted summary judgment on behalf of insured for declaratory relief as to the issue of whether the insurer was permitted to request insured’s attendance at an EUO where the PIP statute contains no such requirement); Y&M Medical Center v. State Farm Fire & Cas. Co., 19 Fla. L. Weekly Supp. 380a (Jan. 18, 2012) (granting plaintiff’s amended cross motion for final summary judgment pursuant to Custer holding that an EUO policy provision in the context of PIP is not a condition precedent to coverage or recovery of PIP benefits as it conflicts with the Florida no-fault law); Central Therapy Center, Inc., v. State Farm Fire & Cas. Co., 19 Fla. L. Weekly Supp. 625a (Apr. 24, 2012) (court held that in light of Custer they disagreed with insurer’s contention that the EUO was a condition precedent to filing a lawsuit for PIP benefits or recovery of PIP benefits); The Personal Injury Clinic v. United Auto Ins. Co., 20 Fla. L. Weekly Supp. 701a (May 3, 2013) (court granted final judgment in favor of the insured in connection with issue of whether EUO was a condition precedent to claim recovery relying on Custer).

Recently, the Florida Supreme Court issued a poignant decision in Nunez v. Geico General Ins. Co,., 117 So. 3d 388 (Fla. 2013). While the Nunez reaffirms the Custer decision as good law, it grapples with the existence of the recent statutory amendments to the PIP statute. Although this decision came down after the effective date of the new PIP amendments (January 1, 2013), retroactive application of the amendments is not applicable as provided for under Florida law. Perhaps another interesting aspect of the Nunez decision is embedded in the court’s analysis. The court’s analysis in Nunez is particularly interesting because it highlights the fact that the statutory regulations of PIP policies add an additional dimension of insurer/insured obligations that is markedly absent from other insurance-based relationships.

Highlighting the distinct nature of the Florida’s no-fault law and the dangers of relying on Florida’s general insurance case law as a one-size-fits-all legal precedent, Justice Perry’s 24-page decision relies heavily on the court’s prior analysis explained as follows:

PIP insurance is markedly different from homeowner’s/tenants insurance, property insurance, life insurance, and fire insurance, which are not subject to statutory parameters and are simply a matter of contract not subject to statutory requirements.

Nunez v. Geico General Ins. Co., 117 So. 3d 338, 392-93 (citing Custer, 62 So. 3d at 1091). This is particularly interesting when you compare it to other Florida case law addressing the importance of policy language relating to conditions precedents and their affect on the insured’s collection of insurance proceeds without compliance. See e.g. Swaebe v. Federal Ins. Co., 374 Fed. Appx. 855 (11th Cir. 2010); El Dorado Towers Condominium Assoc., Inc. v. QBE Ins. Corp., 717 F. Supp.2d 1311, 1320-21 (S.D. Fla. 2010); Coconut Key Homeowners Assoc., Inc. v. Lexington Ins. Co., 649 F. Supp.2d 1363, 1369 (S.D. Fla. 2009); Starling v. Allstate Floridian Ins. Co., 956 So. 2d 511, 513-14 (Fla. 5th DCA 2007); United States Fidelity & Guaranty Co. v. Romay, 744 So. 2d 467 (Fla. 3d DCA 1999); Ferrer v. Fidelity and Guaranty Ins. Co., 10 F. Supp.2d 1324, 1326 (S.D. Fla. 1998), aff’d Galindo v. ARI Mut. Ins. Co., 203 F.3d 771 (11th Cir. 2000); Goldman v. State Farm Fire Gen. Ins Co., 660 So. 2d 300, 303 (Fla. 4th DCA 1995); Ro-Ro Enterprises, Inc. v. State Farm Fire and Casualty Co., Case No. 93-1754, 1994 WL 16782171, *3-*4 (S.D. Fla. 1994); Pervis v. State Farm Fire & Casualty Co., 901 F.2d 944, 946 (11th Cir. 1990).

The two clear messages to take away from the Nunez decision are (1) a case pending or initiated after January 1, 2013 will have to abide by the strict compliance of the amended statute and (2) no-fault law is a unique statutory creature that cannot be interpreted by applying general Florida insurance case law.