On January 2, 2025, the most recent Form I-9 Fine Matrix outlining the costs for Form I-9 compliance violations was published in the Federal Register. After a government audit of an employer’s Forms I-9, Employment Eligibility Verification, by the Department of Homeland Security (DHS), a Notice of Intent to Fine may be issued if paperwork, hiring, or continuing to employ violations are found.

By way of background, section 274A(b) of the Immigration and Nationality Act (INA) requires employers to verify the identity and employment eligibility of all individuals hired in the United States after November 6, 1986. 8 C.F.R. Section 274a.2 designates the Form I-9 as the vehicle for this verification. Employers are required to maintain for inspection original Form(s) I-9 on paper or as an on-screen version of readable paper copies. Form I-9 retention requires employers to retain the Form(s) I-9 for a period of at least three years from the first day of employment or one year from the date employment ends, whichever is longer.

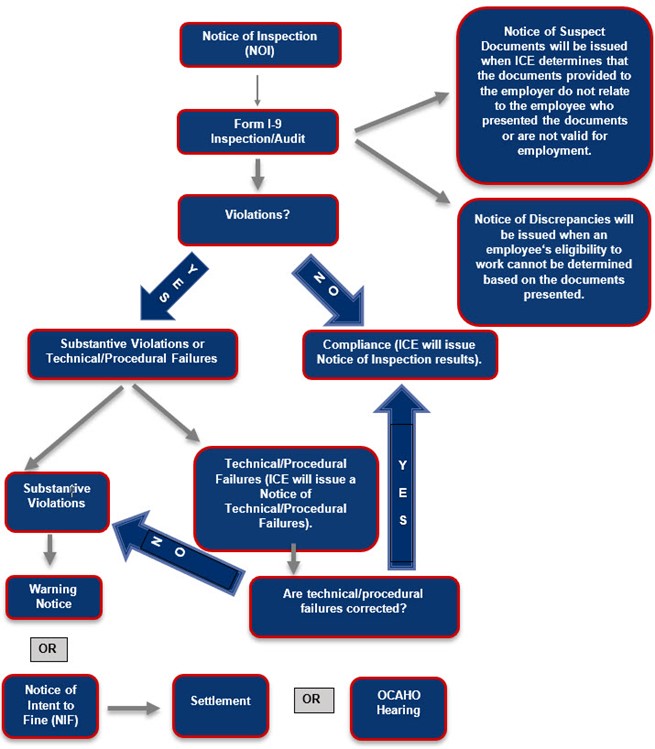

The administrative inspection process is initiated with the service of a Notice of Inspection (NOI) upon an employer. Employers receive at least three business days to produce the Form(s) I-9 requested in the NOI. Employers who physically examine the documentation presented by new employees may choose to make and retain copies or scans of the documentation presented by employees for the purpose of completing the Form I-9. Alternatively, employers that use E-Verify must make and retain copies of documentation presented by employees for List A of the Form I-9. In addition, the employer must provide supporting documentation, such as a copy of the employer’s payroll, a list of active and terminated employees, articles of incorporation, and business licenses.

When an employer responds to an NOI by producing Form(s) I-9, DHS will conduct a compliance inspection of the Form(s) I-9. When technical or procedural failures are identified, the employer receives at least 10 business days to make corrections. An employer may receive a monetary fine for all substantive violations and incorrect technical or procedural failures. Employers who are found to have knowingly hired or continued to employ unauthorized workers will be required to cease the unlawful activity and may be civilly fined and/or criminally prosecuted. Additionally, an employer who is found to have knowingly hired or continued to employ unauthorized workers may be subject to suspension or debarment.

Upon completion of the I-9 inspection, the employer will be notified in writing with one of the following notices:

-

Notice of Inspection Results: Employer is notified that it complies with applicable employee eligibility verification requirements.

-

Notice of Suspect Documents: Employer is notified that the documentation presented by employee(s) does not relate to the employee(s) or are otherwise not valid for employment. The employer and employee(s) are given an opportunity to provide documentation demonstrating valid U.S. work authorization if they believe the finding is in error.

-

Notice of Discrepancies: Employer is notified that the audit cannot determine the employees’ eligibility to work in the United States.

-

Notice of Technical or Procedural Failures: Identifies technical or procedural failures found during the inspection of Form(s) I-9 and gives the employer at least 10 business days to correct the forms.

-

Warning Notice: Issued when substantive verification violations were identified, but there is an expectation of future compliance by the employer.

-

Notice of Intent to Fine (NIF): May be issued for substantive violations, incorrect technical or procedural failures, knowingly hire violations, and/or continuing to employ violations.

A depiction of the entire Form I-9 Inspection Process from Immigration and Customs Enforcement (ICE) is displayed below:

See https://www.ice.gov/factsheets/i9-inspection.

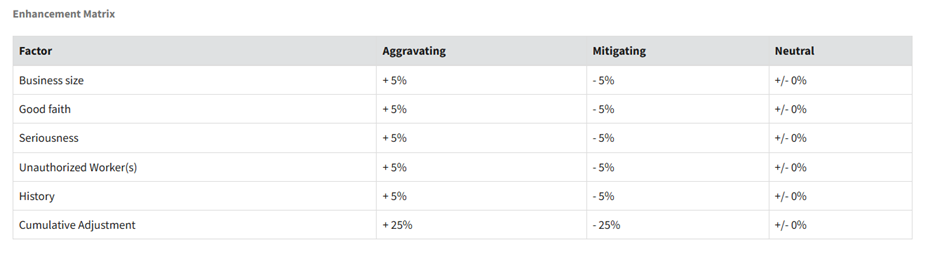

To determine the base fine amount, the number of substantive violations/uncorrected technical or procedural failures and knowingly hire/continue to employ violations will be divided by the number of Forms I-9 that should have been presented for inspection. The percentage from this calculation is the violation percentage that will determine the minimum and maximum civil penalty base fine amount. This percentage may change depending on whether the offense being evaluated is the employer’s first offense, second offense, or a third or higher offense. Once the base fine amount is determined, five statutory factors will be considered to determine total fine amount:

-

Size of the business

-

Good faith of the employer

-

Seriousness of the violation(s)

-

Involvement of unauthorized worker(s)

-

History of previous violation(s)

The following table represents the criteria used to enhance, mitigate, or deem neutral the base fine amount.

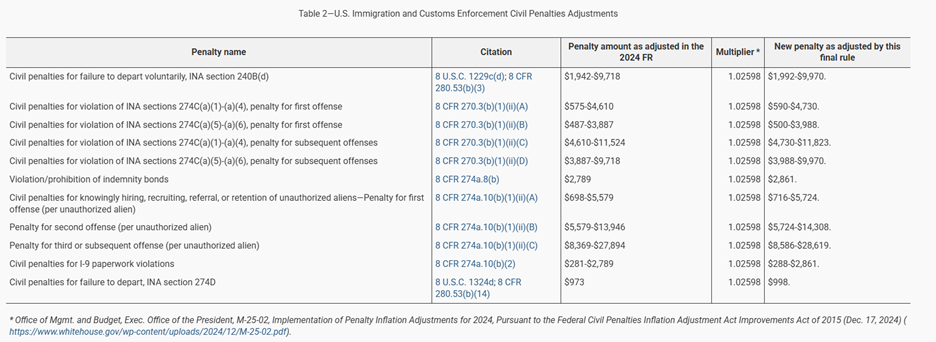

For many years, there has been a large debate over how Form I-9 violation fines are calculated. Typically, ICE would post a Fine Matrix that is used to determine violation amounts based on the increased fines published annually in the Federal Register. The most recent fine adjustments were published on January 2, 2025. Below are the published adjustments for inflation for the upcoming year:

See https://www.federalregister.gov/documents/2025/01/02/2024-31204/civil-monetary-penalty-adjustments-for-inflation#h-24.

We advise clients to immediately begin an internal audit of its I-9 records to ensure compliance with all requirements. This will avoid the need to make changes upon an audit and potential fines.